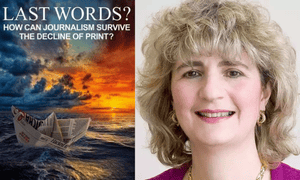

Stockbroking media analysts are dispassionate observers of the industry. One of the most respected of their number is Lorna Tilbian, now head of media at Numis. So what does she think of the current state of play, and the future? Here’s an edited version of her chapter in the forthcoming book, Last words? How can journalism survive the decline of print?

Any financial assessment of print’s structural change has been overwhelmed by the severe downturn in advertising as corporate profitability and consumer confidence collapsed in the wake of the collapse of Lehman Brothers in September 2008.

This downturn has been particularly felt in higher yielding classified advertising sector where the main categories - recruitment, property and motors - have seen declines.

These reflect the initial weaknesses of their underlying markets in combination with the advent of powerful online players such as Rightmove, Auto Trader and Zoopla.

Historically, regional newspapers operated in local near-monopoly situations with respect to local advertisers and readers. But the internet allowed the development of pure-play classified sites that extended beyond print circulation areas.

They built a pre-eminent market share of “eyeballs”, which have provided a powerful barrier to entry to regional publishers who tried to maintain a local, or hyperlocal, alternative.

By contrast, the combined revenues of Rightmove and Zoopla now represent __more than 50% of estate agent marketing spend. As for motors, Auto Trader has been the big digital winner.

Regional newspapers have therefore become increasingly reliant on display advertising.

The circulation of regional papers has been in decline for several decades, reflecting demographic change and increasing competition from other media. Cover price increases have been used to keep circulation revenue decline to single digit percentages.

There has been a divergence in the performance of paid weeklies and morning and evening daily titles. Paid weeklies tend to serve smaller communities where local ties are stronger. As a result, they have experienced __more stable circulation.

By contrast, declines in morning and evening daily titles have been more significant. They tend to serve larger towns and cities where competition from other media is stronger and local community ties are weaker.

The biggest expense in running a newspaper business are employees who account for almost half of industry costs, followed by newsprint, which takes around 10%. The remaining costs are for distribution, production, retailing and general administration.

Continued significant declines in regional display advertising hammer home the structural pressures that publishers continue to face as a result of the transition to digital along with the presence of competing digital players in each of the key advertising markets.

More people are reading newspapers than ever before. But that increased audience is doing so through access to free content on newspaper websites.

And publishers have yet to find an online circulation model that can replicate the circulation revenue stream they made from print.

A subscription model offers several advantages over newsstand copy sales, with greater resilience to economic pressure and the ability to implement smaller, regular price rises.

In addition, a direct billing relationship with readers offers greater potential to sell additional goods and services, while a better knowledge of the reader creates a more attractive advertising proposition. At face value, transition to an online paid model should be more straightforward.

Broadly speaking, publishers have been slow to capitalise on the opportunities that digital presents. Group M estimates digital revenues accounted for just over 22% of regional advertising revenues in 2016.

The next decade will see newspapers move away from a free ad-funded model towards a diverse range of online business models appropriate to the publisher’s readership base.

I think audience reach and demographic are key to determining online success, especially through “enterprise revenues”, those derived from selling additional goods and services to a newspaper’s readership base.

Whilst accounting at present for a small proportion of industry revenue, enterprise will become an increasingly important part of a diversified online model and is an area increasingly being investigated by a number of consumer publishers (both newspaper and magazines).

Four important factors will drive the development of enterprise revenues. First, titles with affluent demographics have had the most success is generating enterprise revenues. Second, the larger the circulation, the larger the potential customer base.

Third, a strong brand is trusted by potential consumers. Fourth, a direct billing relationship with readers, through a pre-paid subscription, provides a powerful advantage in driving enterprise revenues.

The debate over charging for content continues to be at the forefront of the newspaper industry. While a number of paid-content models have been introduced over the last few years, there is limited financial detail allowing an accurate assessment of the relative success of the varying models.

There are clearly a number of paid-content options ranging from a complete “walled-garden” or models that work on a metered basis or pay-per-article. But there are several important factors that must be considered when assessing the paid-content debate.

Firstly, general national and international news has been commoditised and the market for it has been obscured by the BBC’s significant online presence.

Secondly, consumers will only pay for content they value. This can be for its journalistic enjoyment (favouring a particular columnist), its niche content (sports/financial/special interest) or its lack of substitutability.

Thirdly, the addictive popularity of smartphones and tablets may increase readers’ propensity to pay for content that is delivered through an app. Consumers would therefore be paying for “context” as well as content.

In summary, a true digital strategy will incorporate a range of revenue models suitable for the readership size and demographic.

*Last words? How can journalism survive the decline of print? Edited by John Mair, Tor Clark, Neil Fowler, Raymond Snoddy and Richard Tait (Abramis, £19.95). £15 for Guardian readers, available by email to richard@abramis.co.uk